Consumer theory is a theory of microeconomics that relates preferences to consumer demand curves. The link between personal preferences, consumption, and the demand curve is one of the most complex relations in economics. Implicitly, economists assume that anything purchased will be consumed, unless the purchase is for a productive activity.

Preferences are the desires by each individual for the consumption of goods and services, and ultimately translate into employment choices based on abilities and the use of the income from employment for purchases of goods and services to be combined with the consumer’s time to define consumption activities.

Consumption is separated from production, logically, because two different consumers are involved. In the first case consumption is by the primary individual; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved.

The models that make up consumer theory are used to represent prospectively observable demand patterns for an individual buyer on the hypothesis of constrained optimization.

Prominent variables used to explain the rate at which the good is purchased (demanded) are the price per unit of that good, prices of related goods, and wealth of the consumer.

The fundamental theorem of demand states that the rate of consumption falls as the price of the good rises. This is called the substitution effect. As prices rise, consumers will substitute away from higher priced goods and services, choosing less costly alternatives. Payday loans and cash advances become more popular as consumers struggle not to tap into their savings. Subsequently, as the wealth of the individual rises, demand increases, shifting the demand curve higher at all rates of consumption. This is called the income effect. As wealth rises, consumers will substitute away from less costly inferior goods and services, choosing higher priced alternatives.

Model setup

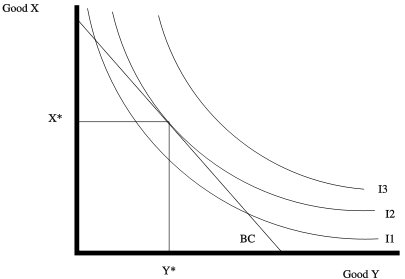

For an individual, indifference curves and an assumption of constant prices and a fixed income in a two-good world will give the following diagram. The consumer can choose any point on or below the budget constraint line BC. This line is diagonal since it comes from the equation ![]() . In other words, the amount spent on both goods together is less than or equal to the income of the consumer. The consumer will choose the indifference curve with the highest utility that is within his budget constraint. Every point on I3 is outside his budget constraint so the best that he can do is the single point on I2 that is tangent to his budget constraint. He will purchase X* of good X and Y* of good Y.

. In other words, the amount spent on both goods together is less than or equal to the income of the consumer. The consumer will choose the indifference curve with the highest utility that is within his budget constraint. Every point on I3 is outside his budget constraint so the best that he can do is the single point on I2 that is tangent to his budget constraint. He will purchase X* of good X and Y* of good Y.

Income effect and price effect deal with how the change in price of a commodity changes the consumption of the good. The theory of consumer choice examines the trade-offs and decisions people make in their role as consumers as prices and their income changes.

Substitution effect

The substitution effect is the effect observed with changes in relative price of goods.

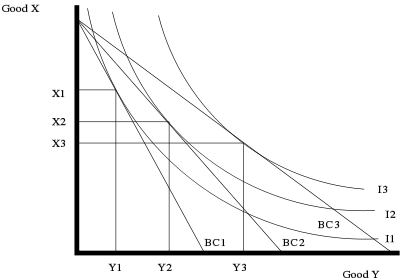

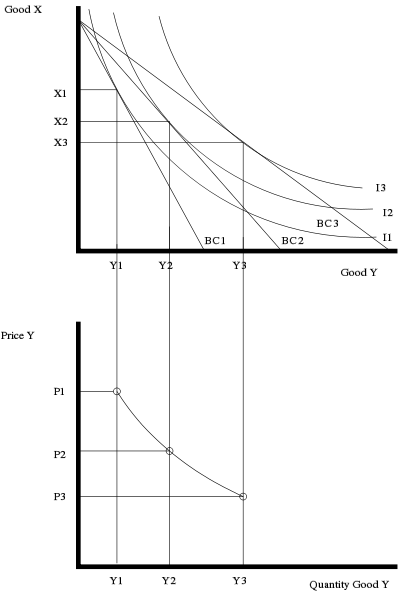

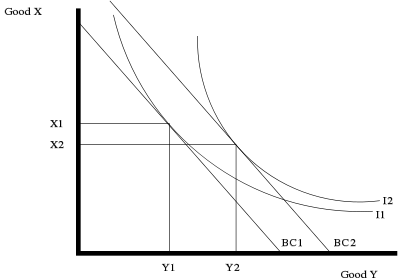

These curves can be used to predict the effect of changes to the budget constraint. The graphic below shows the effect of a price increase for good Y. If the price of Y increases, the budget constraint will pivot from BC2 to BC1. Notice that because the price of X does not change, the consumer can still buy the same amount of X if he or she chooses to buy only good X. On the other hand, if the consumer chooses to buy only good Y, he or she will be able to buy less of good Y because its price has increased.

To maximize the utility with the reduced budget constraint, BC1, the consumer will re-allocate consumption to reach the highest available indifference curve which BC1 is tangent to. As shown on the diagram below, that curve is I1, and therefore the amount of good Y bought will shift from Y2 to Y1, and the amount of good X bought to shift from X2 to X1. The opposite effect will occur if the price of Y decreases causing the shift from BC2 to BC3, and I2 to I3.

If these curves are plotted for many different prices of good Y, a demand curve for good Y can be constructed. The diagram below shows the demand curve for good Y as its price varies. Alternatively, if the price for good Y is fixed and the price for good X is varied, a demand curve for good X can be constructed.

Income effect

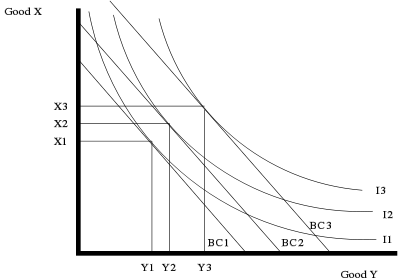

Another important item that can change is the money income of the consumer. The income effect is the phenomenon observed through changes in purchasing power. It reveals the change in quantity demanded brought by a change in real income (utility). Graphically, as long as the prices remain constant, changing the income will create a parallel shift of the budget constraint. Increasing the income will shift the budget constraint right since more of both can be bought, and decreasing income will shift it left.

Depending on the indifference curves the amount of a good bought can either increase, decrease or stay the same when income increases. In the diagram below, good Y is a normal good since the amount purchased increased as the budget constraint shifted from BC1 to the higher income BC2. Good X is an inferior good since the amount bought decreased as the income increases.

![]() is the change in the demand for good 1 when we change income from m’ to m, holding the price of good 1 fixed at p1′:

is the change in the demand for good 1 when we change income from m’ to m, holding the price of good 1 fixed at p1′:![]()

Price effect as sum of substitution and income effects

Every price change can be decomposed into an income effect and a substitution effect; the price effect is the sum of substitution and income effects.

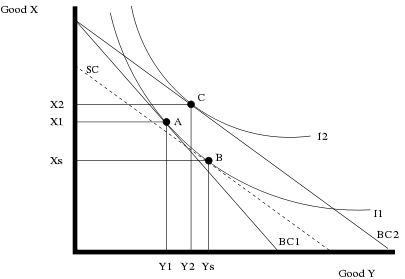

The substitution effect is a price change that alters the slope of the budget constraint but leaves the consumer on the same indifference curve. In other words, it illustrates the consumer’s new consumption basket after the price change while being compensated as to allow the consumer to be as happy as previously. By this effect, the consumer is posited to substitute toward the good that becomes comparatively less expensive. In the illustration below this corresponds to a imaginary budget constraint denoted SC being tangent to the indifference curve I1.

If the good in question is a normal good, then the income effect from the rise in purchasing power from a price fall reinforces the substitution effect. If the good is an inferior good, then the income effect will offset in some degree the substitution effect. If the income effect for an inferior good is sufficiently strong, the consumer will buy less of the good when it becomes less expensive, a Giffen good (commonly believed to be a rarity).

In the figure, the substitution effect, ![]() , is the change in the amount demanded for

, is the change in the amount demanded for ![]() when the price of good

when the price of good ![]() falls from

falls from ![]() to

to ![]() (increasing purchasing power for

(increasing purchasing power for ![]() ) and, at the same time, the money income falls from m to m’ to keep the consumer at the same level of utility on

) and, at the same time, the money income falls from m to m’ to keep the consumer at the same level of utility on ![]() :

:![]()

The substitution effect increases the amount demanded of good ![]() from

from ![]() to

to ![]() . In the example, the income effect of the price fall in

. In the example, the income effect of the price fall in ![]() partly offsets the substitution effect as the amount demanded of

partly offsets the substitution effect as the amount demanded of ![]() goes from

goes from ![]() to

to ![]() . Thus, the price effect is the algebraic sum of the substitution effect and the income effect.

. Thus, the price effect is the algebraic sum of the substitution effect and the income effect.

Labor-leisure tradeoff

Consumer theory can also be used to analyze a consumer’s choice between leisure and labor. Leisure is considered one good (often put on the horizontal-axis) and consumption is considered the other good. Since a consumer has a finite and scarce amount of time, he must make a choice between leisure (which earns no income for consumption) and labor (which does earn income for consumption).

The previous model of consumer choice theory is applicable with only slight modifications. First, the total amount of time that an individual has to allocate is known as his time endowment, and is often denoted as T. The amount an individual allocates to labor (denoted L) and leisure (l) is constrained by T such that:

![]()

or

![]()

A person’s consumption is the amount of labor they choose multiplied by the amount they are paid per hour of labor (their wage, often denoted w). Thus, the amount that a person consumes is:

![]()

When a consumer chooses no leisure (l = 0) then T − l = T and C = wT.

From this labor-leisure tradeoff model, the substitution and income effects of various changes in price caused by welfare benefits, labor taxation, or tax credits using a calculator can be analyzed.